Interest in green and gender budgeting, as well as revenue administration gender equality initiatives, is increasing worldwide. In October 2023, the IMF’s regional capacity development center in Almaty, Kazakhstan arranged a three-day workshop on “Strengthening Budget Institutions and Revenue Administration for Climate Change Action and Gender Equality.” Participants included senior officials from nine countries in the region - Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyz Republic, Mongolia, Tajikistan, Turkmenistan, and Uzbekistan. The event was facilitated with the support of the Swiss State Secretariat for Economic Affairs (SECO).

The workshop covered three core areas for finance ministries and tax administrations: Climate PFM, Gender Budgeting, and Gender Equality related to Revenue Administration.

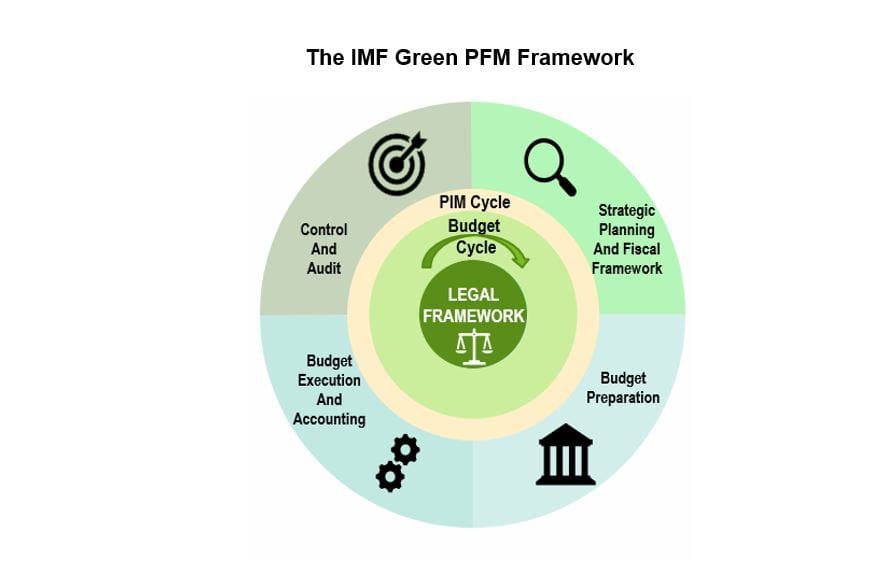

- For the PFM component, the goal was to strengthen the gender budgeting strategies already established in several countries of the region. Participants were also introduced to climate budgeting and the IMF's green PFM framework. The workshop highlighted both the similarities and differences between gender and climate budgeting, paying special attention to practices such as gender impact assessments, and climate and gender tagging. Adopting either a green PFM or a gender budgeting framework is a gradual process that needs to be adapted to country needs and circumstances, and finance ministries should play a leading role in the process.

- Under the revenue component, participants explored revenue administration principles and practices that support gender equality from two perspectives: (i) achieving gender equality in the tax administration workforce, and (ii) the revenue authority’s role in boosting women’s economic participation by applying a gender lens when administering tax laws and facilitating trade.

The workshop also discussed the role of finance ministries in promoting green PFM and gender-related budgeting, and strategies to address implementation challenges and improve countries’ engagement.

- Source: Gender budgeting in G20 countries (IMF, Nov 2021).

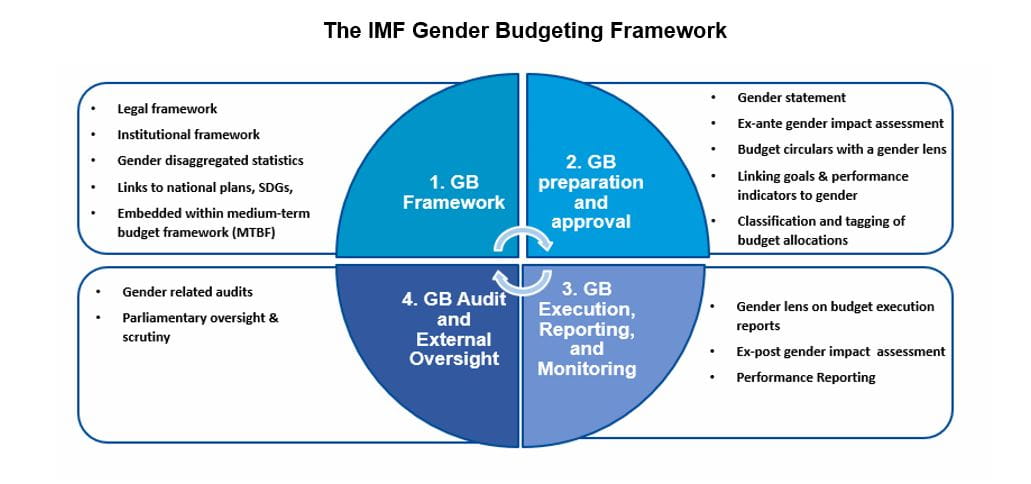

The IMF Gender Budgeting framework (see chart) emphasizes a comprehensive and integrated gender perspective throughout the budget cycle. Gender Budgeting is an approach that uses fiscal policy and PFM instruments to advance gender equality. It is not just about funding explicit gender equality initiatives. It entails analyzing fiscal policies and budgets to understand their impact – intended and unintended – on gender equality, using this information to design and implement effective gender equality policies.

The use of gender budgeting tools can identify gender equality gaps and focus on more effective targeted policies, spending allocations and revenue measures that reach the entire population or are non-discriminatory (often unintentionally due to lack of information or inertia).

Green PFM (see chart) integrates a climate-friendly perspective into PFM practices, systems, and frameworks – especially the budget process – with the objective of promoting fiscal policies that are responsive to climate (and environmental) concerns. Green PFM is about working out how the existing system can be reformed to better support the design and implementation of green objectives and public policies. It can be a key enabler of an integrated government strategy to combat climate change. The IMF approach builds green budgeting elements into all elements of the budget cycle by developing and refining existing PFM processes rather than building an entirely new PFM system.

Gender Equality and Revenue Administration

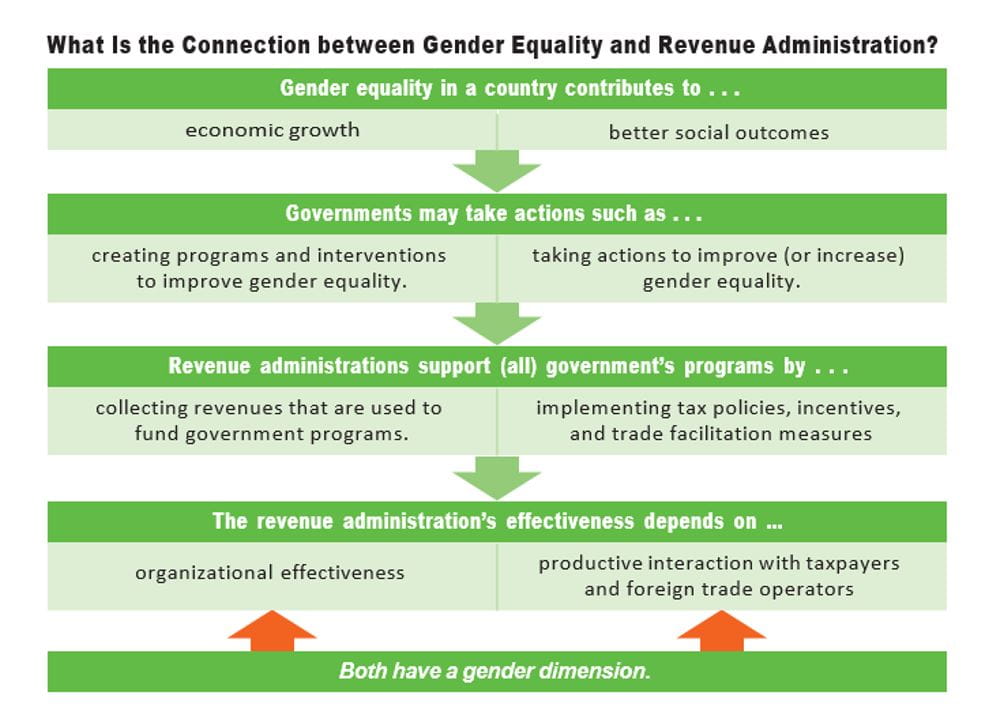

Gender equality is a core component of fiscal reform and plays a key role in achieving more inclusive and sustainable economic growth. Revenue administrations can leverage their relationships with taxpayers and traders to strengthen the participation of these groups in the economy (see chart).

Through their effective and efficient collection of tax revenue, revenue administrations provide funds for governments to finance spending in many areas that support women and girls: water, sanitation, social protection programs (such as maternal and parental leave, paid childcare), targeted social transfers, health, education, public sector wage policies that help close seniority and income gaps, and digitalization.

Finally, revenue agencies can develop gender-balanced and inclusive workforces through policies and procedures that ensure equal employment opportunities.